Buy-to-let landlords are being hit by higher interest rates, higher costs and a less friendly tax regime.

Many have seen their mortgage costs spiral meaning they will be hoping for falling interest rates just as much as homeowners and first-time buyers.

There are almost two million buy-to-let properties that have a mortgage attached, according to the trade association for the banking and financial services sector, UK Finance.

The average two-year fixed rate buy-to-let mortgage is currently 4.9 per cent, according to Moneyfacts. The average five-year fix is 5.23 per cent.

The lowest five-year fixed rate deal the market is currently 2.99 per cent while the lowest two-year fix is 1.69 per cent, albeit the latter in particular come with very hefty fees.

We look at what landlords need to consider when taking a new mortgage, and list some of the best deals available – both for those who own in their own name and for those who own via a limited company.

> Quick link: Compare the best buy-to-let mortgage deal for you

How cheap are buy-to-let mortgage rates?

Many landlords who own with a mortgage will be seeing their profits decimated by higher mortgage rates, having been lulled into a false sense of security by the ultra-cheap finance available in recent years.

Mortgaged buy-to-let investors often use interest-only mortgages to ensure higher cashflow. But when paying interest-only, if the mortgage rate doubles or triples, so do the monthly payments.

The average five-year fixed rate buy-to-let mortgage rate is 5.23 per cent, according to Moneyfacts.

It means a typical landlord requiring a £200,000 interest-only mortgage on a five-year fix will need to pay £872 a month in mortgage costs if buying or remortgaging at the moment, excluding fees.

Add that to the cost of periods where the property is empty, repairs, maintenance, letting agent fees, compliance checks, insurance and service charges and it shows how reliant many landlords will be on rents rising in order to turn a profit.

What about limited company mortgage rates?

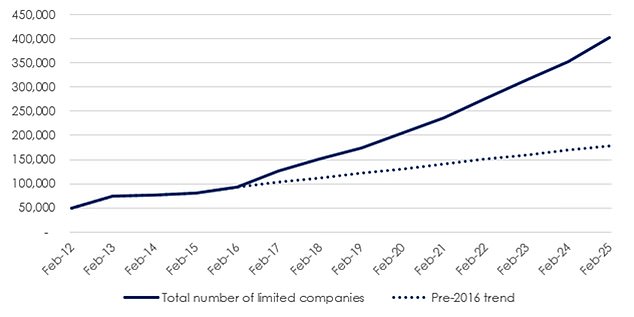

The number of companies holding buy-to-let property in the UK has passed 400,000, according to analysis of Companies House data by Hamptons.

It comes after a record breaking 61,517 new buy-to-let limited companies were set up in 2024, a 23 per cent increase on what had previously been a record set in 2023.

Holding property in a limited company, also known as ‘incorporating’, is an alternative to holding property in one’s personal name, and the tax structure is different.

Hamptons found that since February 2016, the number of buy-to-let companies has risen by 332 per cent, going from 92,975 to 401,744.

It means that Companies House now has more companies registered to hold buy-to-let property than for any other type of business.

For those who own in a limited company, average rates are typically slightly higher with bigger product fees on top.

The average two-year fixed rate limited company mortgage is 5.15 per cent while the average five-year fixed rate limited company mortgage is 5.53 per cent, according to Moneyfacts.

The downside is that these will likely be accompanied by higher fees. The upside is that limited company landlords can fully deduct their mortgage interest costs from their tax bill.

The number of companies holding buy-to-let property in the UK rose from 92,975 to 401,744 between February 2016 and February 2025

Howard Levy, director of buy-to-let lending at mortgage broker SPF Private Clients, says: ‘Many landlords who own in their own name are incorporating their portfolios, and others are selling up given the profits they were making are now losses due to tax changes.

‘Many landlords fixed their mortgages three, four or five years ago, so there will be a tranche of funds coming up for review in the next 12 to 24 months and it will be interesting to see what happens.

‘The main determinant will be where interest rates are at that time, or more specifically about four to six months prior to those rates expiring.’

Tax perks: As the gap between personal and corporate tax rates may widen further in the Budget, there has been a surge of landlords incorporating

What does it mean for landlords?

Many of the landlords who are now remortgaging had become accustomed to rock bottom rates.

Someone who purchased five years ago will have enjoyed an average fixed rate of around 2.5 per cent.

It means on a £200,000 mortgage they would have factored in monthly mortgage costs of around £417 – not the £872 or so they are likely to face when remortgaging today.

That said, mortgage rates are lower than they were during the summer last year meaning the situation is not as dire as it was.

The average two-year fixed rate for buy-to-let reached a high of 6.97 per cent in July 2024, while the average five-year fixes hit 6.82 per cent.

Some landlords will also do much better than the market average, by using a whole-of-market mortgage broker to find them a cheaper rate. This will depend to some extent on how much equity they have in the property.

A word of warning here: many of the lowest buy-to-let mortgage rates come with staggeringly high fees. These can be as high as 10 per cent of the total mortgage amount in some cases. On a £200,000 mortgage that would equate to £20,000.

This means it’s essential to look at the overall cost of the mortgage and factor in both the fees and the interest rate.

To secure the cheapest deal, landlords will also typically need to be buying with at least a 40 per ent deposit or be remortgaging with at least 40 per cent equity in the property.

Financial shock: Many landlords who own with a mortgage will be seeing their profits cut down by higher mortgage rates

Howard Levy, director of broker SPF Private Clients, says: ‘Landlords who need to remortgage within the next six months or so should consider booking a fixed rate now, in case rates rise between now and when they need to move onto the new deal.

‘If rates do rise, you will be pleased you took this precaution; if, on the other hand, rates were to fall, then you should be able to book onto a new, lower rate instead of the higher, reserved rate.

‘With buy-to-let mortgages, whether you opt for a fixed rate or base-rate tracker will partly depend upon which best fits with your rental stress tests.

‘If you are purchasing a new buy-to-let, then usually you will have to opt for a five-year fixed rate unless you are putting significant funds in for your deposit.

‘If you don’t have the funds available for a sizeable deposit, then the choice of deal is largely taken out of your hands.’

How to assess where mortgage rates are heading?

Nobody wants to lock into a 5.25 per cent five-year fix in 2025 only to find they could have remortgaged onto a 3 per cent rate in 2027 if they had opted for a two-year fix instead.

The next 0.25 percentage point cut by the Bank of England was previously forecast for December 2025. However, the chance of that happening is now considered to be 50-50.

Markets are now not fully pricing in another cut until the bank’s February meeting, after which base rate is then expected to settle at 3.5 per cent in the middle of next year.

There are some forecasts that suggest interest rates will fall further. HSBC and UBS for instance are forecasting that interest rates will fall to 3 per cent by the end of 2026.

There are also some that think interest rates will stay higher. Analysts at Pantheon have forecast that interest rates will finish 2026 at 4 per cent.

Expert: Howard Levy, director of buy-to-let lending at mortgage broker SPF Private Clients

Lenders tend to price their fixed-rate mortgages based on future market expectations for the Bank of England’s base rate.

Market expectations are reflected in swap rates – financial market rates which anticipate where interest rates will be in two and five years’ time, when fixed mortgages lent today will expire.

As of 21 August, five-year swaps were at 3.77 per cent and two-year swaps are at 3.7 per cent.

This would suggest that fixed mortgage rates will only fall significantly if future interest rate expectations fall further over the coming months and years.

You can check best buy tables and the best mortgage rates for your circumstances with our mortgage finder powered by London & Country – and figure out what you’ll actually be paying by using our new and improved mortgage calculator.

Should you fix or take a tracker?

The case in favour of fixing for five years

Five-year fixes currently offer some of the cheapest deals, and having certainty over monthly payments for the next five years may also appeal to some borrowers, given how much interest rates have shot up over the past 24 months.

And fixing for five years, rather than two years, can sometimes enable landlords to borrow more.

This is because lenders tend to impose more generous affordability tests.

‘The bigger landlords seem to be sticking with five-year fixes, preferring to lock in for the longer term,’ said Levy.

‘They do get the equivalent of pound cost averaging though, as rate expiries are coming up for these clients all the time, so if rates drop they book a five-year fix at that time for the next few properties for example.

‘For those who own buy-to-lets in their personal name, typically, a five-year fix will be stressed at a lower rate than a two-year fix.

‘Given the existing borrowing, higher rates and higher interest cover ratios, it may not be possible to raise the level of funds required without fixing for five-years in some cases.’

‘Paying higher product fees, achieving higher rental incomes, or not being classed as a higher-rate taxpayer are also ways to boost maximum borrowing levels.’

The case in favour of fixing for two years

Many of those opting for a two-year fix will be doing so because they think interest rates will fall over the next couple of years.

They are banking on the expectation that once inflation subsides, the base rate – and then mortgage rates – will come down, allowing them to fix at a cheaper rate.

Nicholas Mendes of mortgage broker John Charcol says: ‘Predicting the trajectory of mortgage rates over the coming years is still risky business and while it is important to understand the market and make a balanced view on future rate movement it should not influence your decision if your someone who requires a longer period of stability. Getting the right advice is key.

‘If inflation continues to pose a challenge, we should expect bank rate to be higher for longer, which would in turn result in a period of higher mortgage rates.

‘But, given the current movement and overall landscape, I do expect to see a gradual reduction in mortgage rates over time.’

Broker, Howard Levy, argues that many landlords are avoiding the stress testing required for shorter fixes by sticking with their current lender when they refinance.

He adds: ‘Two-year fixed rates don’t usually fit stress tests on a remortgage, unless the loan-to-value is relatively low, but they would be available for a product transfer.

‘We are seeing many clients opt for a two-year fix for a product transfer with the view that in two years’ time rates will be lower so they can remortgage onto a more palatable rate.’

The case in favour of a tracker mortgage

Those that are confident of rates falling faster and further than expected may even be trying their luck with a tracker mortgage.

Trackers follow the Bank of England’s base rate, plus or minus a set percentage.

For example, someone could be paying base rate plus 0.5 per cent on top with a tracker. With the base rate at 4.5 per cent, they’d pay 5 per cent at present.

But if the base rate was cut to 3.5 per cent, for example, their rate would fall to 4 per cent.

The main benefit of tracker deals is that they typically don’t come with early repayment charges.

This means if mortgage rates fell over the coming year, someone with a tracker deal could switch to a cheaper fixed deal as and when they liked.

On the flip side, if the base rate stays the same or even rises this year, it could end up becoming an expensive gamble.

It’s also worth pointing out that at present, tracker rates tend to be more expensive than fixed rates.

Howard Levy adds: ‘Ensure you have a surplus from the rent above and beyond the mortgage payments, and also to ensure that if you opt for a tracker you are happy with the risk that rates might increase later down the line and that you have a sufficient buffer – be it rental surplus or your own funds – to cope with such a scenario.’

Gamble: At present, borrowers opting for a tracker deal will likely pay more than if they fix. The hope is that interest rates will fall.

What are the best buy-to-let rates?

Below, we highlight some of the best deals available to buy-to-let landlords.

Buy-to-let mortgage rates often come with product fees that can be as high as 10 per cent of the loan. The below are the deals with the cheapest overall annual costs when both the initial rate, fees (for arrangement and valuation etc), and cashback are taken into account.

This is based on the property value being £200,000. The mortgages sourced are available for remortgage deals. For those purchasing, rates may be slightly different.

Please note, these rates were the best deals sourced as of 21 August 2025.

Cheapest deals for those owning in their personal name

40% deposit mortgages

Five-year fixed rate mortgages

NatWest has a five-year fixed rate at 4.04 per cent with a £954 fees at 60 per cent loan to value.

Leeds Building Society has a five-year fixed rate at 4.23 per cent with £0 fee at 60 per cent loan to value.

Two-year fixed rate mortgages

BM Solutions has a two-year fixed product at 2.78 per cent with 3 per cent fee at 65 per cent loan to value.

NatWest has a two-year fixed rate at 3.99 per cent with £954 fees at 60 per cent loan to value.

25% deposit mortgages

Five-year fixed rate mortgages

Virgin Money has a five-year fixed rate at 3.75 per cent with a 3 per cent fee at 75 per cent loan to value.

BM Solutions has a five-year fixed rate at 3.76 per cent with a 3 per cent fee at 75 per cent loan to value.

Two-year fixed rate mortgages

The Co-operative bank has a two-year fixed rate at 4.48 per cent with £0 fees at 75 per cent loan to value.

BM Solutions has a two-year fixed rate at 2.98 per cent with a 3 per cent fee at 75 per cent loan to value.

Best two-year tracker without early repayment charges

40% deposit

Skipton Building Society has a two-year tracker at 4.72 per cent with £745 fees at 60 per cent loan to value. This is base rate (4 per cent) plus 0.72 per cent.

25% deposit

TSB has a two-year tracker rate at 4.84 per cent with £1,004 fee at 75 per cent loan to value. This is base rate plus 0.84 per cent.

Cheapest limited company remortgage options

Again, this is based on a property value of £200,000 and is the cheapest remortgage deals overall based on rates and fees.

The below mortgages were sourced by specalist buy-to-let mortgage broker SPF Private Clients.

40% deposit mortgages

Five-year fixed rate mortgages

State Bank of India has a five year fix at 4.75 per cent, with a £1,500 product fee. There is a £300 cashback.

This is a green mortgage product for those with a property that has an EPC rating of A, B or C.

Next best non-green rate is 4.85 per cent with a £1500 fee (again State Bank of India).

Two-year fixed rate mortgages

Leek Building Society has a two year fix product at 4.88 per cent, with a £995 product fee. There is £400 cashback.

This is a green mortgage product for those with a property that has an EPC rating of A, B or C.

Next best non-green rate is 3.40 per cent with a 4 per cent fee (Paragon Bank).

25% deposit mortgages

Five-year fixed rate mortgages

Leek Building Society has a five year fix product at 5.06 per cent, with no product fee. There is £400 cashback.

This is a green mortgage product for those with a property that has an EPC rating of A, B or C.

Next best non-green rate is 3.72 per cent with a 6 per cent fee (Vida Bank).

Two-year fixed rate mortgages

Leek Building Society has a two year fix product at 4.88 per cent, with a £995 product fee. There is £400 cashback.

This is a green mortgage product for those with a property that has an EPC rating of A, B or C.

Next best non-green rate is the same product with Leeks without the cashback.

#buytolet #mortgages #landlords #fix #risk #tracker