House prices have seen their biggest monthly rise of the year so far, according to Halifax, as mortgage rates keep falling and banks offer bigger home loans.

The mortgage lender said the average price went up by 0.4 per cent in the month of July, making the typical home worth £298,237.

This was compared to £297,157 in June.

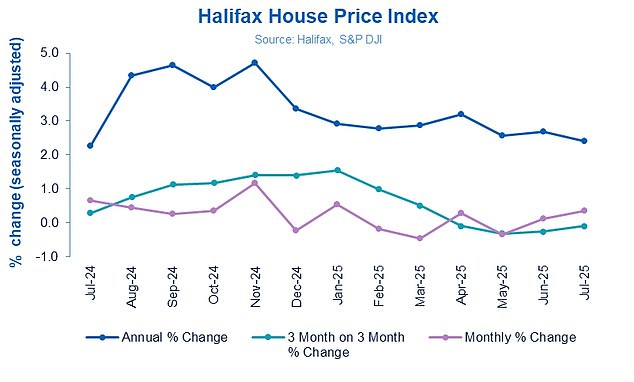

The recent monthly price high was in November 2024, as home buyers were keen to complete sales before a stamp duty increase in April 2025. Then, prices rose by 1.2 per cent in a month.

In July, price growth slowed slightly compared to the same time last year. In the twelve months to July, property values went up 2.4 per cent, whereas in June they had risen 2.7 per cent.

Halifax said price rises were being driven by mortgage interest rates gradually falling, as well as recent moves by lenders to increase the amount some people could borrow.

Uptick: The average house price increased in the month of July, according to Halifax

It comes ahead of the Bank of England’s decision on interest rates later today, where it is anticipated to cut the base rate from 4.25 per cent to 4 per cent.

While mortgage lenders price in likely future interest rate movements in advance, lower interest rates will contribute to more mortgage rate cuts over time.

The average two-year fixed residential mortgage rate today is 5 per cent and the average five-year fixed rate is 5.01 per cent – but the cheapest deals are now sub-4 per cent for those with the biggest deposits or most equity.

Recently, Rachel Reeves backed moves by mortgage lenders to loosen their lending rules and allow more people to borrow up to six times their income.

Lenders have also adjusted their ‘stress rates’, where they test borrowers’ ability to continue to pay their mortgage if the rate increased.

Amanda Bryden, head of mortgages at Halifax, said: ‘Challenges remain for those looking to move up or onto the property ladder. But with mortgage rates continuing to ease and wages still rising, the picture on affordability is gradually improving.

‘Combined with the more flexible affordability assessments now in place, the result is a housing market that continues to show resilience, with activity levels holding up well.

‘We expect house prices to follow a steady path of modest gains through the rest of the year.’

Over time: Halifax said the typical house price was £298,237 in July 2025

Fixed-rate mortgage warning

Bryden also pointed out that the end of second half of this year would see an uptick in people coming to the end of fixed-rate mortgage deals.

Those coming to the end of five-year deals would likely see their repayments spike, as these were taken out during the pandemic-era property boom when interest rates were in some cases less than 1 per cent.

Those coming off a two year fixed-rate would be likely to see their payments fall, however, as they would be exiting mortgage deals locked in rates during the rate peak that followed the 2022 mini-Budget.

Bryden added: ‘We’re unlikely to see a significant impact on house prices, but it may influence market dynamics if prospective home movers choose to delay plans as a result of tighter budgets.’

Tom Bill, head of UK residential research at the estate agent Knight Frank, said he expected house price growth by the end of 2025 to be ‘low single-digit’ but that this depended on what happened in the autumn Budget.

‘Some parts of the economy are already adopting the brace position and buyers could begin to hesitate after the summer if speculation over tax rises persists,’ he added.

Northern Ireland sees biggest house price gains

Northern Ireland continues to see house prices rise the quickest, and prices have risen by 9.3 per cent over the last year according to Halifax.

The typical home there now costs £214,832.

Scotland saw prices increase 4.7 per cent to an average of £215,238, while Wales saw a rise of 2.7 per cent to an average of £227,928.

The North West and Yorkshire and the Humber reported the highest rate of property price inflation among English regions, up 4 per cent over the last year to £242,293 and £215,532 respectively.

London and the south east continued to lag behind, recording 0.5 per cent growth over the year, but the south west saw even lower growth at 0.2 per cent.

#House #prices #biggest #monthly #rise #YEAR #banks #offer #cheaper #bigger #mortgages