Home sellers risk waiting months to sell their home if they price their property too highly, Zoopla has warned.

The property portal revealed homeowners who end up having to cut their asking price take two and half times longer to sell than those that have no price reduction.

In some parts of the country, more than a quarter of homes for sale have been on the market for over six months.

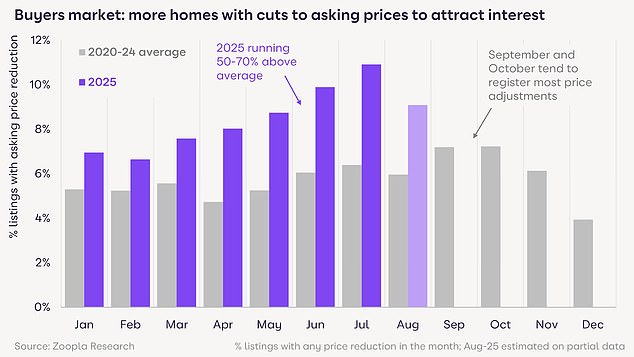

Last month, one in ten homes registered a cut to the asking price, well above the five-year average of 6 per cent suggesting we remain firmly in a buyers market.

Getting the price right is key to selling in a timely manner, according to Richard Donnell, executive director at Zoopla.

Buyers market: More homes with cuts to asking prices are being recorded this year in order to attract interest

‘There is plenty of demand for homes and more people are looking to move,’ said Donnell. ‘However, buyers also have much greater choice to choose from, especially across areas of southern England.

‘There is a clear link between buyer choice and price inflation and how long it is taking homes to sell.

‘Sellers need to understand local market conditions when considering how to market their home, setting the right price and how quickly they would like to sell.

‘The risk of being too ambitious on price is your home taking more than twice as long to find a buyer – or not selling at all.’

Tax rumours putting buyers off

Seller hoping that autumn will bring a wave of new buyers may also need to be mindful of recent tax speculation concerning the upcoming budget.

These include a lifetime cap on gifts, which could have an impact on how much the Bank of Mum and Dad can help with first-time buyer deposits.

The government is also reportedly considering plans to scrap stamp duty and council tax in favour of a new system.

Potentially, the stamp duty bill homeowners pay on purchase could be scrapped in favour of an annual tax for homes above £500,000.

Separately, it has been rumoured that homes above £1.5million may be subject to capital gains tax when they are sold.

The risk is that this creates uncertainty for home buyers in the coming weeks ahead of the Autumn Budget. History shows that tax changes can impact market activity and buyer expectations.

‘A price-sensitive housing market has become a whole lot more price-sensitive over the last fortnight thanks to the speculation around property taxes,’ said Tom Bill, head of UK residential research at Knight Frank.

‘With supply still outweighing demand as autumn approaches, we expect price growth this year to hover not far above zero.

‘A November Budget means weeks of more speculation in a tiresome re-run of 2024 that will keep a lid on transaction activity and stamp duty revenue.’

Tax rumours: Buyers will be concerned about possible tax changes, including the idea of an annual property tax and the possibility that some sellers may have to pay capital gains tax

What’s happening to house prices

The average house price is 1.3 per cent higher over the last year, according to Zoopla, meaning the typical home is now worth £270,600, or £3,560 more than a year ago.

It marks a slowdown from the 2.1 per cent price growth recorded at the start of 2025, but is higher than 0.6 per cent this time last year.

Zoopla says the key reason for the lack of house price growth is due to buyers having greater choice of homes for sale.

It revealed there are 10 per cent more properties on the market than last year.

Jeremy Leaf, north London estate agent and a former RICS chairman, said: ‘The market inevitably lost a little steam over the summer period with so many decision makers away and listings continuing to pile up.’

Amy Reynolds, head of sales at Richmond estate agency Antony Roberts, added: ‘We are seeing a lot of price reductions. It’s a real challenge to get pricing right at the moment with all the political talk around potential tax changes, as well as the significant amount of stamp duty buyers face.’

More homes listed for sale: There are 10 per cent more properties on the market than last year

Meanwhile, what buyers can afford to pay is still somewhat limited by mortgage rates, especially across Southern England.

While buyers can now get rates around the 4 per cent mark, this is rather different than rates of between 1 and 2 per cent that were enjoyed in the pre 2022 era.

Tomer Aboody, director of specialist lender MT Finance thinks that there are potentially too many buyers holding out for rates to fall.

‘Since we have possibly seen the final base rate cut of the year, buyers may need to get used to the new ‘norm’ for mortgage rates for the foreseeable future,’ said Aboody.

‘Anyone waiting to buy either takes the plunge or might have to wait until 2026 and the possibility of further rate cuts.

‘With little assistance from the Government in the form of helping the market, with stamp duty changes and further taxes on homes in the pipeline, a slowdown in transactional volumes can be anticipated.’

| Region | Avg time on market to sold subject to contract (days) | Avg annual price change (%) |

|---|---|---|

| N West | 27 | 2.7% |

| N East | 27 | 2.1% |

| Yorks’ & H | 32 | 2% |

| W Mids | 34 | 1.8% |

| Wales | 34 | 2.1% |

| E Mids | 38 | 1.3% |

| Eastern | 38 | 0.7% |

| S West | 38 | 0.3% |

| London | 39 | 0.5% |

| S East | 40 | 0.3% |

| England & Wales | 35 | 1.3% |

| Source: Zoopla | ||

Where is it easiest to sell right now

How hard it is to sell one’s home will greatly depend on where they live in the country.

In northern regions, a combination of fewer homes on the market than a year ago is leading to quicker sales times.

For example, the average time to sell a home in the North West and North East of England in July was 27 days, 23 per cent faster than the national average of 35 days.

This is helping fuel above average house price growth in these areas which is sitting at 2.7 per cent and 2.1 per cent respectively.

In contrast, regions across southern England are experiencing a stronger buyer’s market.

The supply of homes for sale is higher than a year ago and this has extended the time it takes to agree a sale to an average of 39 days in July, according to Zoopla, which is 11 per cent longer than the national average.

Longer sales times are translating into almost static prices in the south, with house price growth sitting as low as 0.3 per cent in the South East and South West.

Analysis of markets with the most unsold homes shows that coastal areas across southern England have the most competition among sellers.

In Truro, Exeter, and Bournemouth, more than a quarter of homes for sale have been on the market for over six months, more than a third higher than the average.

This increased choice, a result of a larger number of second homes for sale in response to higher council tax, is also impacting prices, which are 1.1 per cent and 1.4 per cent lower than a year ago in these markets.

Other areas with an above-average number of unsold homes include York, Torquay, and Llandrindod Wells in Wales, markets where sellers need to be most realistic on price if they want to sell this year.

However, there are markets with a lack of supply, including Dundee, Wolverhampton, some outer suburbs of London, and Northampton.

#Homes #priced #high #long #sell #sale #signs #continue #increase