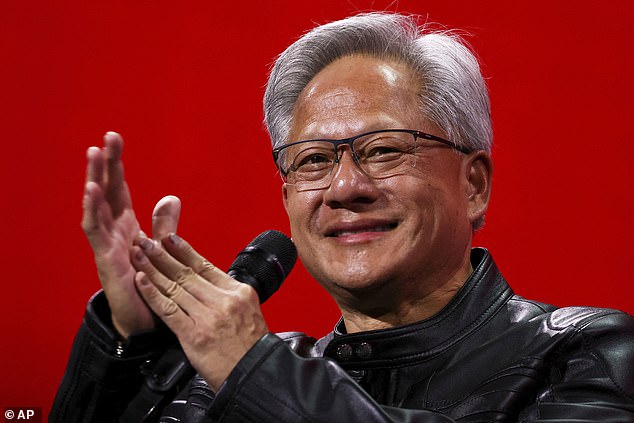

Jensen Huang, the brilliant Taiwanese-American electrical engineer, chose the name Nvidia for the company because one of his two co-founders wanted competitors to be ‘green with envy’.

As the clever clogs will already know, without any help from Google, the name is based on the Latin word, invidia, which is the sense of envy of people looking on too closely.

They chose well, and they have certainly made their Silicon Valley peers more than envious. More pertinently, they have also earned themselves great kudos.

The three co-founders, who each invested $200 in the start-up more than three decades ago, are now multi-billionaires having gone on to create the world’s most valuable company, worth more than $4trillion, and one of its most profitable.

Having initially designed a graphics processing unit – known as a GPU – for gaming, the trio have moved on to becoming the world’s biggest supplier of chips for artificial intelligence (AI).

In that respect, their competitors, investors and indeed clients, are all looking more than closely at Nvidia’s latest results because its performance is seen as a bellwether for AI demand.

Jensen Huang chose the name Nvidia for the company because one of his two co-founders wanted competitors to be ‘green with en’

That makes it a little fragile, too, as any slip is viewed through a microscope to judge whether the hype is overblown or that the AI revolution is only just beginning. That’s certainly the more likely scenario as Nvidia’s latest results suggest.

For now, the chipmaker is steaming ahead: in the second quarter of the year, revenue shot up by 56 per cent to $46.7billion (£34.5billion), year-on-year.

Nor does there seem to be any let-up. As Huang says: ‘The AI race is on.’

He predicts revenue rising again to roughly $54billion in the next three months, higher than forecasts.

The results also show that two direct customers for GPUs – most likely Microsoft and Meta – account for nearly half of revenues from the Data Centre operation.

While such a heavy dependence on so few big clients is not always smart, the reality is that the big tech companies are unlikely to find another supplier like Nvidia for its chip designs.

Indeed, its GPUs are used by all the big tech companies that are training AI models, including ChatGPT from OpenAI and Gemini at Google. It’s also moving up ‘the stack’, as they say, offering bundled services that run off its chip designs.

Analysts reckon that Nvidia’s growth will continue to soar and that heavyweight investors, rather than the venture capitalist which invested early on, will keep pouring money in as it’s now a safe haven, representing around 8pc of the S&P 500 stock market.

No surprise to see some froth on the shares come off on profit-taking – but they are still up 35 per cent on the year.

The bigger risk is geopolitical, and how Nvidia and fellow chipmaker AMD manage relations with President Donald Trump and his trade war with China.

The two chipmakers have struck a deal to pay the Trump administration a 15 per cent slice of Chinese sales, in return for export licences.

That came after Huang successfully lobbied Trump to reverse a ban on sales, prompted by fears that the chips would be used by the Chinese military.

The greater, if not existential, risk is, of course, how relations develop between China and Taiwan, where most of the world’s chips are made.

Green hypocrisy

Visiting the Drax power plant in Selby, North Yorkshire, is mind-boggling and unsettling because of its contradictions.

Stacked in vast, cathedral-like domes are millions of tonnes of biomass pellets – made of wood shipped from American forests some 2,000 miles away to create electricity for UK homes.

Even ultra-greens argue that shipping wood across the Atlantic is as ecologically damaging as burning coal. More worryingly, the plant gobbles up billions of pounds in taxpayer subsidies because the electricity is treated as renewable.

Even that is contentious: experts claim Drax spews out more carbon dioxide than the dirtiest coal station.

So it’s right that the Financial Conduct Authority is investigating the source of the pellets after an insider said it has misled shareholders.

It would be ironic if it fell to the City regulator to expose the hypocrisy behind Drax, and the millions it has cost taxpayers.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#boom #begun #puts #China #Taiwan #sharp #focus #MAGGIE #PAGANO