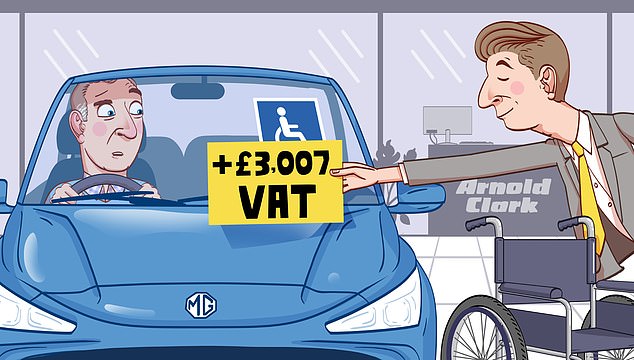

I am disabled following a traffic accident in 2023 and am in dispute with Arnold Clark Automobiles regarding £3,007 VAT unfairly charged on a car I bought from one of its dealerships in October 2024.

I believe I should have been told I was eligible for a VAT exemption. Please help.

W. R., Whitley Bay, Tyne and Wear.

Sally Hamilton replies: You explained to me the tragic background to your disability, caused when a speeding driver knocked you down in December 2023, leaving you with life-changing injuries.

You are now an above-knee amputee after undergoing gruelling treatment as well as rehab over nine months, before finally being able to return home in September 2024.

Now 68, you told me it was your ambition during rehab to be able to drive again and regain your independence.

Exemption: A reader was charged £3,007 VAT on a modified car they bought from Arnold Clark Automobiles despite them having been left disabled following a traffic accident

Soon after you got home, you and your wife started shopping for a vehicle at Arnold Clark’s Shiremoor dealership in Newcastle and eventually opted for an £18,000 MG3 hybrid.

Having visited the showroom twice in your wheelchair and minus your right leg, it was clear for anyone to see that you were disabled.

But you say at no point did anyone explain that you could qualify for a VAT exemption on a car that is modified for your disabilities.

Staff did direct you to recommended firms that could carry out such modifications, though, so they knew this was your intention.

You asked one of these firms, Bewick Mobility, to conduct the work and they rightly explained these would be VAT-exempt.

You only became aware that the VAT rule could have applied to a full car purchase in February 2025 during a chance conversation with a patient at your rehabilitation clinic.

You swiftly requested a refund of VAT from Arnold Clark, but it refused and simply told you to ask HM Revenue & Customs.

But it didn’t play ball, either. I checked the rules with HMRC. It confirmed disabled drivers cannot reclaim VAT from them but must instead seek a refund from the dealer, which assesses eligibility.

HMRC added that to qualify, cars must have been designed for a wheelchair user or be ‘substantially and permanently’ adapted to allow them to travel. My worry was that your motor was adapted after you purchased it.

Despite this, I thought the lack of guidance in the showroom would give Arnold Clark pause for thought and encourage it to offer a goodwill gesture to cover your VAT bill.

After all, had you known the facts, you might have made different decisions or even shopped elsewhere.

I asked Arnold Clark why you hadn’t been steered in the right direction by staff and whether it would consider refunding the VAT. I was disappointed by its response.

It confirmed that staff are trained to advise on entitlements for Motability customers (those on certain mobility benefits who want to use these payments to lease a new car under the Motability Scheme for disabled drivers), whereas cash buyers don’t get similar help.

It suggested you should have carried out your own research on entitlements in advance of shopping with them.

A spokesperson for Arnold Clark adds: ‘We cannot advise on specific funding options or support available outside of the [Motability] scheme.

‘We recommend that the customer seeks independent guidance from relevant organisations or local authorities to explore what financial assistance or grants may be available to them.’

I asked Motability Operations – the firm that delivers the Motability Scheme on behalf of the Motability Foundation charity – for tips on when a disabled driver obtains a new car.

A spokesperson says: ‘Dealers are trained to support people who want to lease a Motability Scheme vehicle and can provide advice to those who wish to lease a car.

Any training or guidance about how to apply HMRC VAT rules for car purchases would be a matter for the dealership.’

So, alas, I have hit a roadblock with your complaint. On my suggestion, you are now taking your case to the Motor Ombudsman in the hope it takes a different view.

British Gas refund was made out to my late sister

I am executor for the estate of my sister, who passed away in June 2024.

Utilities and house insurance bills were paid and mail redirected to me until her house was sold in July this year.

All meter readings were taken and sent to the relevant utilities. On July 7, 2025, a cheque arrived from British Gas refunding a credit of £246.70, but it was made out to my dead sister.

I needed to add this sum to her estate so the solicitor could complete her affairs.

I have contacted British Gas several times to get this matter resolved to no avail. Please help.

M. F., Hertfordshire.

Sally Hamilton replies: Sorting out the financial affairs of a dead relative can be extremely stressful, but to see the whole process held up by one relatively small cheque from

British Gas was upsetting and driving you to distraction. You were told on several occasions that a replacement cheque made out to you was on its way… but nothing arrived.

By early September you had run out of energy pursuing the company, which is when I stepped in.

Within a few days British Gas finally arranged for £246.70 to be sent to you by bank transfer instead, along with the promise of the same amount to you personally as a goodwill gesture to make up for the poor experience.

It admitted your request in June to update the account into the name of the estate wasn’t actioned correctly, which led to the refund cheque being issued in your sister’s name.

I hope the staff involved get a refresher course on how to properly close a late customer’s account when in credit.

You told me how grateful you were for my intervention and were relieved the process of winding up and distributing your sister’s estate can be completed.

- Write to Sally Hamilton at Sally Sorts It, Money Mail, Northcliffe House, 2 Derry Street, London W8 5TT or email sally@dailymail.co.uk — include phone number, address and a note addressed to the offending organisation giving them permission to talk to Sally Hamilton. Please do not send original documents as we cannot take responsibility for them. No legal responsibility can be accepted by the Daily Mail for answers given.

#Car #dealership #didnt #qualified #VAT #discount #disabled #SALLY #SORTS