Worried savers pulled more than £70billion from their retirement pots last year as fears mount of another pensions tax raid in November’s Budget.

The figures from the Financial Conduct Authority, the City regulator, marked a 36 per cent increase on the previous year, and led to warnings from finance experts for pension savers to ‘think twice’ before dipping into the nest eggs.

The withdrawal rush comes amid growing speculation that Rachel Reeves will slash the tax-free lump sum that can be drawn down after the Chancellor brought retirement savings into inheritance tax from 2027.

Pension savers are currently able to withdraw up to a quarter of their pension pots tax free from the age of 55 – up to a maximum of £268,275.

But cutting the limit is in the crosshairs of Torsten Bell, a former Resolution Foundation think-tank chief who was made pensions minister this year and will now play a key role in Budget preparations.

Bell has called for a sharp cut in the tax-free withdrawal threshold to just £40,000.

He also supports reforming pensions tax relief.

Cash grab: There was a big rise in people accessing pension funds last year, FCA data shows

Savers currently enjoy tax relief at their higher marginal rate, meaning the more you earn the more tax benefit you get when you and your employer pay into a workplace pension.

But the Foundation proposes ‘rebalancing’ this relief, which cost taxpayers £48.7 billion in 2023, ‘towards low-to-middle earners’.

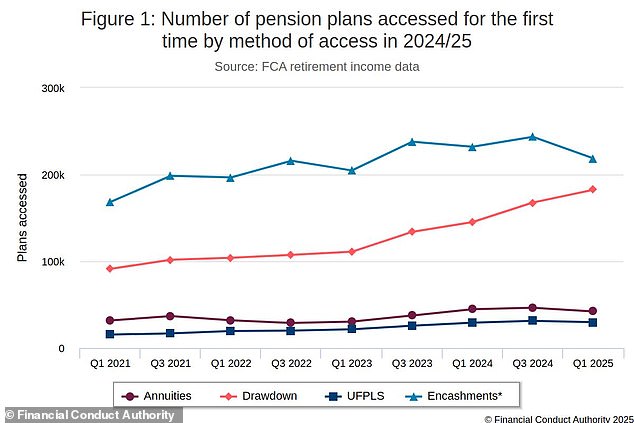

The FCA found overall value of money being withdrawn from pension pots increased to £70.9billion in 2024/25 from £52.2billion in the previous year.

Just 30.6pc of pension plans accessed for the first time were held by savers who took regulated advice – down from 30.9 per cent in 2023/24.

‘We would encourage all pension savers to think twice before making major withdrawals from their pots, especially in anticipation of rumoured policy changes that might not materialise’ said Andrew King, retirement specialist at wealth management firm Evelyn Partners.

Money out: The withdrawal rush comes amid growing speculation that Rachel Reeves will slash the tax-free lump sum that can be drawn down

SAVE MONEY, MAKE MONEY

Sipp cashback

Sipp cashback

£200 when you deposit or transfer £15,000

4.38% cash Isa

4.38% cash Isa

Trading 212: 0.53% fixed 12-month bonus

£20 off motoring

£20 off motoring

This is Money Motoring Club voucher

Up to £100 free share

Up to £100 free share

Get a free share worth £10 to £100

No fees on 30 funds

No fees on 30 funds

Potentially zero-fee investing in an Isa or Sipp

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.

#Savers #pulled #70bn #pension #pots #year #fears #mount #Budget #tax #raid