Nvidia is expected to deliver a £7.8 billion increase in profits as it continues to rake in cash despite growing fears of an AI-fuelled stock market bubble.

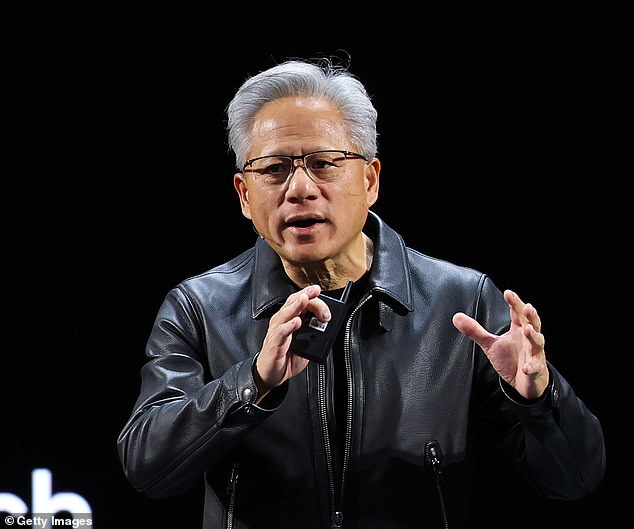

The US computer chip giant, led by Jensen Huang is the world’s most valuable company at £3.4 trillion, and is forecast to report a profit of £22.4 billion for the three months to October – up from £14.6 billion last year.

Sales are also expected to have surged to £41.5 billion from £26.6 billion when the tech group delivers its figures on Wednesday, according to data firm Refinitiv.

The bumper results come as Nvidia looks to bolster confidence among investors that soaring demand for its computer chips will continue to drive profits and its share price.

Boom: Nvidia, led by Jensen Huang (pictured), is the world’s most valuable company at £3.4 trillion

Nvidia’s stock has risen by 37 per cent so far this year and last month it became the first company in history to be worth $5 trillion.

The shares have fallen back since then but are still 1,300 per cent higher than they were five years ago.

Shareholders have become jittery after Japanese technology investor Softbank dumped its entire £4.4 billion stake in Nvidia last week, fuelling fears the tech giant’s sky-high value could be brought crashing back down to earth. Concerns were heightened when Softbank finance chief Yoshimitsu Goto admitted: ‘I can’t say if we’re in an AI bubble or not.’

Fears that the sector could soon be heading for a downturn sparked a £400 billion sell-off in AI stocks earlier this month.

Nvidia was among the big names to suffer a share price slump alongside other chipmakers and AI names such as Palantir and Taiwan Semiconductor Manufacturing Company (TSMC).

It followed warnings from the bosses of investment banking giants such as Goldman Sachs, JP Morgan Chase and Morgan Stanley that a correction in the market was likely in the next one to two years.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#giant #Nvidia #set #reveal #blockbuster #22bn #profit