Shareholders in investment trust Temple Bar have seen the value of their holdings surge over the past five years – but according to the fund’s managers, the party’s not over yet. Far from it.

Ian Lance and Nick Purves, part of global investment house Redwheel, claim that there are more stellar gains to come, albeit not on the scale of the recent past.

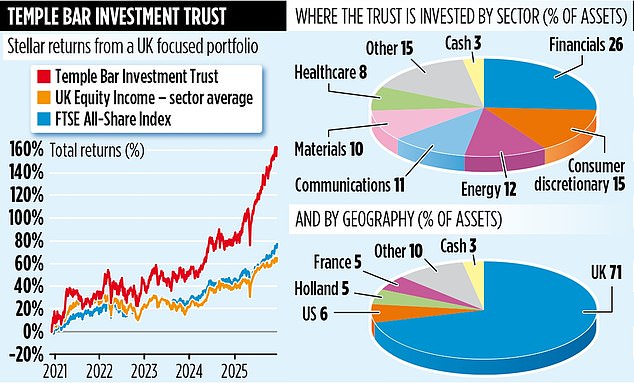

Since mid-November 2020, the trust, invested primarily in UK stocks, has delivered returns of 158 per cent, more than twice that from the FTSE All-Share Index (77 per cent) and the average for its UK equity income peer group (61 per cent).

Their modus operandi is built around value. Lance says: ‘We identify chronically undervalued companies and then hold them in the expectation of their real value coming through.

‘When they become winners, we run with them while trimming the holdings to help rotate the trust towards areas of the market where we see new opportunities.’

When the managers took over at the helm in late October 2020, finding ‘value’ stocks was not difficult given the dire economic backdrop as the UK lurched from one lockdown to another.

Lance says: ‘We bought shares in Marks & Spencer for under £1, while shares in NatWest had plunged to the level they traded at in the depths of the 2008 financial crisis. We were brave, the shares were distressed, but we held our nerve and our approach has been vindicated.’

Over the past five years, shares in M&S and NatWest have jumped 193 per cent and 292 per cent respectively. Both stocks remain in the fund’s top-ten holdings.

Although Lance says UK company valuations are nowhere near as distressed as they were in 2020, he insists that undervalued stocks can still be found.

For example, they took a position early this year in Johnson Matthey, a UK business specialising in precious metals and clean power. It followed US activist investor Standard Investments taking a stake and accusing management of ‘sustained underperformance’.

In May, Johnson Matthey announced that it would be selling its catalyst technologies unit to US conglomerate Honeywell for £1.8 billion, with shareholders benefiting by way of a future special dividend.

Lance says: ‘We initially had a 3 per cent stake. Today, as a result of the strong performance of the shares, Johnson Matthey is our biggest holding at 5.6 per cent.’

While the trust’s 37 holdings are largely UK stocks (Dutch financial group NN is the only non-UK listed company among the top ten), the managers can invest up to 30 per cent of assets overseas.

Four months ago they used the profits generated from shaving their stakes in UK banks to build positions in South Korean banks Hana and Woori.

Lance says: ‘Usually, when we buy into a company, we do so because something is wrong. But with these banks that wasn’t the case. They were just undervalued and offering a dividend yield of 7 per cent. Both holdings are up in value by more than 30 per cent.’

The manager believes US equities are overvalued, compared to European, Japanese and UK shares, and warns that the artificial intelligence (AI) bubble ‘could burst’. If so, he says a trust such as Temple Bar will offer protection because of its emphasis on low-value stocks.

The fund has £1.1 billion of assets, low annual charges of 0.61 per cent, and pays quarterly dividends. The shares trade just above £3.60, a small premium to the value of the underlying assets. Its market ticker is TMPL and identification code BMV92D6.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#TEMPLE #BAR #INVESTMENT #TRUST #bosses