Rachel Reeves’ pay-per-mile tax on electric vehicles will create an ‘impossible challenge’ for car makers and force them to ration the availability of petrol models, a major dealership boss has warned.

Last week, the headline motoring policy announced in the Autumn Budget was a 3p-a-mile ‘eVED’ tax on EVs from 2028 – a measure designed to recoup losses in fuel duties collected from petrol and diesel car drivers as more of the nation’s motorists switch to battery-powered models.

While the Government for years have scrambled to find a solution for the shrinking motoring tax revenue triggered by the transition to EVs, car makers have dubbed eVED as ‘sending the wrong signal’ and the ‘wrong tax at the wrong time’.

Manufacturers are facing fines if they fail to meet binding sales EV targets over the next decade, and policies that strangle consumer appetite for these cars could create ‘turmoil’ for the motor sector.

Robert Forrester, chief executive of nationwide motor showroom Vertu Motors, says the Chancellor’s eVED tax raid on EVs will be a hammer blow to demand and force brands to restrict the number of petrol cars they bring into the country.

He told The Telegraph that makers would only be able to meet the Zero Emission Vehicle (ZEV) mandate’s targets by restricting availability of combustion engine models to artificially inflate EV sales shares.

Robert Forrester, chief executive of Vertu Motors, says the pay-per-mile tax raid on EVs will likely force brands to restrict the number of petrol cars they bring into the country

Under the mandate’s rules, 28 per cent of all passenger cars sold in the UK by manufacturers in 2025 need to be zero emissions – essentially EVs.

However, official market data shows that – at the end of October – just 22.4 per cent of all registrations so far this year are electric cars, putting the industry more than five percentage points below this binding required threshold.

Makers who fail to hit these numbers face fines of £12,000 per car below the threshold.

And with these targets increasing annually – rising to 33 per cent in 2026 and 80 per cent by 2030 – auto companies ahead of last week’s pay-per-mile announcement had already told This is Money that limited appetite for EVs was make these objectives unfeasible for the industry.

With the arrival of eVED in 2028 likely to further strangle appetite, Forrester says manufacturers will be left with little choice but to inflate the prices of petrol and diesel models and limit their availability in a bid to usher buyers towards purchasing EVs instead.

He said that the industry was already facing a ‘very significant challenge’ to hit the ZEV mandate targets before last week’s Budget announcement, but eVED is now likely to exacerbate the issue.

The dealership boss said this will trigger a ‘rationing situation’ that will ultimately push the price of new petrol and diesel cars higher.

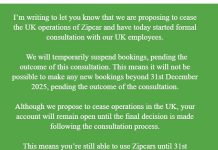

The ZEV mandate was introduced last year and has annually-increasing EV sales share targets up to 2035. For this year, 28% of passenger cars manufacturers sell need to be zero emissions – next year the threshold rises to 33%. Failure to achieve this results in fines of £12,000 per vehicle below the target

Official sales figures published by the SMMT show that just 22.4% of registrations in 2025 (by the end of October) are battery electric vehicles – that more than 5% points below the ZEV threshold

The Office for Budget Responsibility (OBR) said on Wednesday that it expects the new per-mile tax to reduce electric vehicle sales by 440,000 across the rest of the decade.

‘This new charge is likely to reduce demand for electric cars as it increases their lifetime cost,’ it said.

‘To meet the mandate, manufacturers would therefore need to respond through lowering prices or reducing sales of non-EV vehicles.’

However, the Treasury later said the OBR’s calculation failed to acknowledge the Chancellor’s announced £1.3billion in additional funding to extend the electric car grant until 2030, which will partly offset the impact of eVED and trigger an EV shortfall closer to 120,000 units between now and 2030.

Chancellor Rachel Reeves announcing pay-per-mile taxation for EVs on Wednesday said: ‘All cars contribute to wear and tear on our roads, so it is only right that our motoring taxes cover EVs via a modest per mile levy, with extra support to keep EV ownership attractive’

The OBR said it expects the new per-mile tax to reduce electric vehicle sales by 440,000 across the rest of the decade

But Mr Forrester said insists that pay-per-mile taxes will make the problem of limited appetite ‘even more serious’ and create an ‘impossible challenge’ for car makers who last year provided £4billion in EV discounts to hit the ZEV’s targets.

He said eVED ‘puts another concern in the minds of consumers and businesses’ and that it is ‘completely obvious’ there’s going to be a ‘reduction in volume’ of petrol and diesel cars to manipulate the market share of combustion engine units versus battery electric.

He also warned that Britain is at risk of ‘going on a completely different path’ to the rest of Europe, with the European Union currently weighing whether to relax its own vehicle emission targets, including a later deadline of 2035 to outlaw sales of new petrol and diesel cars.

The Society of Motor Manufacturers and Traders (SMMT) last week said the introduction of pay per-mile EV tax will ‘reduce demand for the very vehicles manufacturers are compelled to sell’ and warned it will ‘reduce further the UK’s investment appeal just as it strives to attract new manufacturing operations given the Industrial Strategy’s ambition to boost vehicle output to 1.3million units by 2035’.

Mike Hawes, the trade body’s chief executive, added: ‘Introducing a new electric-Vehicle Excise Duty is the wrong measure at the wrong time.

‘This new tax will undermine demand, so government must work with industry to reduce the cost of compliance and protect the UK’s investment appeal.’

Ford and Polestar are just two car makers that have lambasted the Government’s decision to introduce pay-per-mile taxation on EVs from 2028

Car giant Ford said in the wake of Reeves’ announcement on Wednesday that eVED ‘sends a confusing message’ to drivers at a time when the EV transition is stumbling: ‘Extra investment in charging and the Electric Car Grant is positive, but it cannot offset the impact of a poorly timed pay per mile charge on EVs and hybrids.

‘Against a hugely challenging market, and compliance targets drifting out of reach, this is the wrong tax at the wrong time.’

Matt Galvin, managing director of EV manufacturer Polestar, on Wednesday also said: ‘We have always been clear that EV drivers should contribute their fair share to road costs.

‘But today’s Budget sends the wrong signal by penalising the very drivers who are accelerating the transition to clean transport. If this is one of the goals then a review of fuel duty which hasn’t changed since 2011, would also be welcome.’

#Paypermile #tax #EVs #trigger #petrol #car #rationing #force #prices #higher #dealership #boss #warns