If you want to know how Asda lost its way under the Issa brothers take a trip to South Manchester. At one end, opposite the Heineken brewery in the heart of Moss Side, an Asda superstore is in a deprived community whose cash-strapped shoppers value low prices for essential food and clothes.

The site, on one of the busiest roads into and out of the city centre, used to sell the cheapest petrol for miles around.

That was until Asda’s new owners – who made their money from the Euro Garages forecourt retailing group they founded – decided to whack up the price in Moss Side and elsewhere.

Mohsin Issa was forced to defend the move in front of MPs investigating rising petrol costs in the cost-of-living crisis, but he failed to provide convincing answers to their most basic questions.

That wasn’t the end of it. A few months later, Asda bought a store from Booths – the so-called ‘Waitrose of the North’ – in leafy Mancunian suburb Hale Barns. This home to soap stars and Premier League footballers is a world away from Moss Side and Asda’s core customers.

What were the Issas thinking? Did they want to force rival retail bosses living in the village to shop in one of their stores?

Out of their depth: Asda’s struggling owners Mohsin, left, and Zuber Issa

Whatever the reason, it was another sign the brothers were out of their depth in the cut-throat world of supermarkets.

Some say they loaded the dice against themselves when they piled Asda with huge debts in a £6.8 billion deal with private equity group TDR Capital in 2021.

Press coverage of Mohsin Issa’s extra-marital relationship with former EY tax partner Victoria Price was also a distraction. EY had been Asda’s auditors while Price was at the firm, though she never worked on the account.

Reports that their relationship caused a rift between the brothers were denied but Zuber sold his stake to TDR, making it the majority shareholder. Mohsin is no longer on the operational side of Asda, though he retains a 22.5 per cent stake and a seat on the board.

It took the arrival of former Asda boss Allan Leighton as executive chairman to lead an attempt to return the store to its low-cost roots and restore the That’s Asda Price tagline.

Rivals: Aldi will soon overtake Asda, where, in the 12 weeks to November 1, sales fell by 6.5 per cent

But a year on, he has yet to turn the ship around. Latest figures show Asda’s market share at 11.8 per cent according to data firm Worldpanel – its lowest since the retail research firm began collecting the information in 2011. In the 12 weeks to November 1, sales fell by 6.5 per cent making Asda by far the worst performer, according to another researcher, NIQ.

Stripping out food price inflation, that implies the volume of goods sold has fallen by 10 per cent.

The slump was ‘remarkable’ said Clive Black, analyst at broker Shore Capital, adding ‘Asda’s momentum is exceptionally weak’ going into the key Christmas trading period. What’s most worrying is it comes after Asda completed the separation of its IT systems from its previous owner Walmart.

The overhaul, the biggest in European retail and overseen by Mohsin Issa, was meant to steady the ship. Instead, it seems only a matter of time before discount retailer Aldi overtakes Asda as the UK’s third biggest grocer behind Tesco and Sainsbury’s.

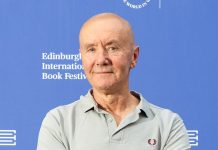

Struggle: Asda boss Allan Leighton

‘If current sales trajectories continue, Aldi could feasibly overtake Asda in the next six to 12 months, particularly if cost-of-living pressures persist and shoppers remain focused on value,’ said retail expert Jonathan de Mello.

‘Asda retains a strong customer base and has been investing heavily in price and own-label ranges, so much will depend on how successfully it can communicate and deliver value to shoppers over the crucial Christmas and early 2025 trading periods.’

A source close to Asda said: ‘It will take time to rebuild market share, as it does in the grocery sector, but we remain confident in our long-term strategy and our fantastic customer proposition.’

The source added that Asda had re-established itself as the UK’s cheapest traditional supermarket, improved product availability and enhanced customer experience.

In the meantime Leighton, 72, soldiers on without a chief executive – a post that has remained vacant for more than four years.

Anyone who is anyone in the grocery world has been approached, including former Aldi and Tesco UK boss Matthew Barnes.

But none have accepted what is widely seen as a poisoned chalice.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

#save #Asda #overtaken #Aldi #months